No Tax on Overtime Calculator - Free Tax Savings Tool

What is the No Tax on Overtime Calculator?

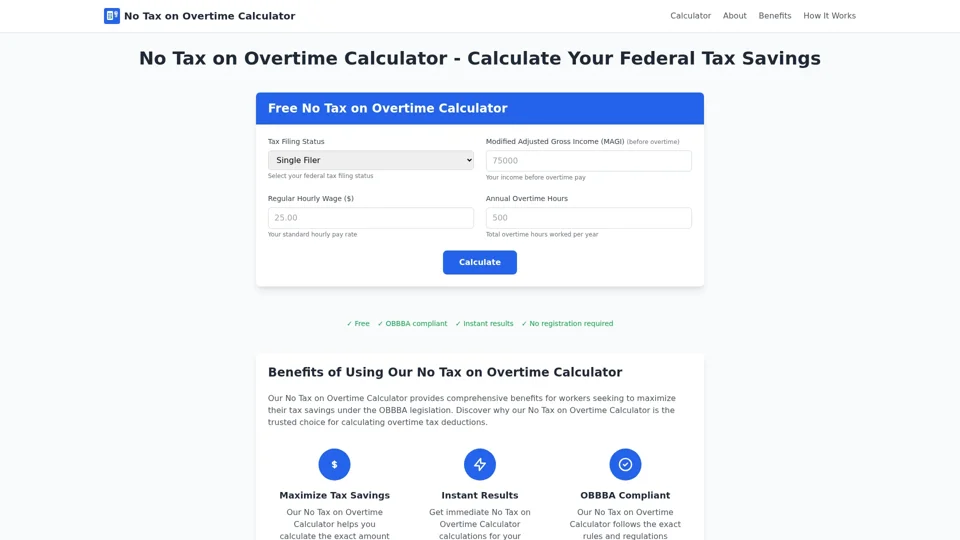

The No Tax on Overtime Calculator is a free online tool designed to help workers calculate their federal tax savings under the One Big Beautiful Bill Act (OBBBA) 2025-2028. This calculator provides an estimate of the tax deduction available for qualified overtime premium pay, allowing users to maximize their tax savings.

Benefits of Using Our No Tax on Overtime Calculator

Our No Tax on Overtime Calculator provides comprehensive benefits for workers seeking to maximize their tax savings under the OBBBA legislation. Discover why our No Tax on Overtime Calculator is the trusted choice for calculating overtime tax deductions.

How the No Tax on Overtime Calculator Works

Understanding how our No Tax on Overtime Calculator works is essential for maximizing your tax savings. Our No Tax on Overtime Calculator follows a simple four-step process to determine your eligible deductions.

Step 1: Enter Your Income Information

Input your regular hourly wage, annual overtime hours, and Modified Adjusted Gross Income (MAGI) into the No Tax on Overtime Calculator to begin the calculation process.

Step 2: Calculate Overtime Premium

The No Tax on Overtime Calculator determines your overtime premium (the extra 50% you earn for overtime hours) which is the basis for the tax deduction under OBBBA.

Step 3: Apply Income Thresholds

The No Tax on Overtime Calculator applies income thresholds ($150,000 for single filers, $300,000 for married filing jointly) and calculates any reductions to your deduction cap.

Step 4: Get Your Tax-Free Amount

The No Tax on Overtime Calculator provides your final calculation showing the exact amount you can deduct from your federal taxes, helping you maximize your tax savings.

About the One Big Beautiful Bill Act (OBBBA)

The One Big Beautiful Bill Act (OBBBA), effective from 2025-2028, introduces a groundbreaking federal income tax deduction for qualified overtime premium pay. This historic legislation allows American workers to deduct overtime premium payments from their federal taxes, providing significant tax relief for hardworking employees across the nation.

Key Benefits of OBBBA

• Deduct overtime premium from federal taxes • Up to $12,500 deduction (single filers) • Up to $25,000 deduction (married filing jointly) • Reduces taxable income, not a tax credit • Applies to FLSA-qualified overtime only • No additional paperwork required

Important Limitations

• Income thresholds apply ($150K/$300K) • Only overtime premium portion is deductible • Temporary provision (2025-2028 only) • Social Security/Medicare taxes still apply • Must follow FLSA overtime rules • Phase-out for high-income earners

Who Benefits Most from No Tax on Overtime Calculator?

The No Tax on Overtime Calculator provision primarily benefits middle-income workers who regularly work overtime hours. This includes healthcare workers, manufacturing employees, service industry workers, and many others who depend on overtime pay to support their families.

Frequently Asked Questions

Get answers to common questions about our No Tax on Overtime Calculator and how it can help you maximize your tax savings under the OBBBA legislation.

What is the overtime premium calculation?

The overtime premium is the additional 50% you earn for overtime hours under the Fair Labor Standards Act (FLSA). For example, if your regular wage is $20/hour, your overtime rate is $30/hour, and the deductible premium is $10/hour. Our No Tax on Overtime Calculator uses only this premium portion to qualify for the tax deduction.

How does the income threshold work?

If your Modified Adjusted Gross Income (MAGI) exceeds $150,000 (single) or $300,000 (married filing jointly), the No Tax on Overtime Calculator reduces your deduction by $100 for every $1,000 over the threshold. This phase-out ensures the benefit primarily helps middle-income workers.

Is this provision permanent?

No, this provision is temporary and only applies to tax years 2025 through 2028 under the One Big Beautiful Bill Act. The No Tax on Overtime Calculator will be relevant during this period, and Congress would need to extend or make it permanent through new legislation.

Does this apply to state taxes?

The OBBBA deduction calculated by our No Tax on Overtime Calculator only applies to federal income tax. State tax treatment may vary depending on your state's tax laws and whether they conform to federal tax provisions.

Who qualifies for this deduction?

You must be eligible for overtime pay under the FLSA (typically hourly workers), work more than 40 hours per week, and receive time-and-a-half pay for overtime hours. Our No Tax on Overtime Calculator is designed for these qualifying workers, as salaried exempt employees typically don't qualify.

How accurate is this calculator?

Our No Tax on Overtime Calculator uses the exact formulas and thresholds specified in the OBBBA legislation. The No Tax on Overtime Calculator provides highly accurate estimates, but individual tax situations vary, and you should consult a tax professional for personalized advice.

Can I use the calculator multiple times?

Yes, you can use our No Tax on Overtime Calculator as many times as needed to explore different scenarios. The No Tax on Overtime Calculator is completely free and allows unlimited calculations to help you understand your potential tax savings.

What records do I need to keep?

Keep detailed records of your overtime hours, pay stubs showing overtime premium payments, and your W-2 forms. The OBBBA requires employers to separately report overtime wages, making it easier to claim the deduction calculated by our No Tax on Overtime Calculator.